Introduction

If you pass on and don’t leave a will in Arizona, your closest relatives will receive your assets according to the state laws on intestate succession. Keep in mind that only the assets you would’ve included in your will (which are usually in your own name) are impacted by these laws. Estate planning concerns can get complex, so it’s advisable to consult an estate planning attorney if you have any questions.

What You Should Know About Intestate Succession Laws in Arizona

- Creating a will is important for making sure your assets are distributed according to your wishes

- Intestate succession laws govern who will receive your assets when you pass on, if you choose not to create a will

- Certain assets won’t be subject to these laws, including retirement account funds

- If you’re confused about how intestate succession laws will impact your inheritance, it’s best to consult an attorney

Intestate Succession in Arizona

Some of your valuable assets won’t pass through your will or be affected by the state laws on intestate succession. This may include property in a living trust, proceeds from life insurance, transfer-on-death registered vehicles, retirement account funds, transfer-on-death account securities, and property you own with right of survivorship or joint tenancy.

Other assets this may involve are real estate held by a beneficiary deed or transfer-on-death account, and payable-on-death accounts. These assets go to the beneficiary or surviving owner named, even if you didn’t create a will.

Who Will Receive Your Assets?

According to intestate succession laws, which of your relatives will receive your assets depends on whether you have close relatives (including living parents or children) when you pass on. If you pass on and have children but no spouse, your children will inherit everything. If you have a spouse but no descendants, your spouse will receive your assets.

For those who are married and have descendants with their spouse, the spouse will inherit everything. For people with a spouse and children from another partnership, the spouse will inherit half of all separate property.

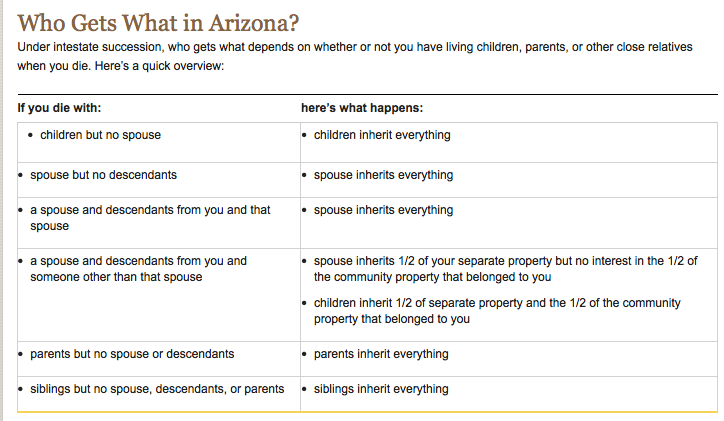

Nolo provides a visual on scenarios of who would inherit what if no will was in place. See below:

Community Property in Arizona

Under state law, if you have a spouse and pass on without a will, your property will be distributed to your spouse according to how you owned it. Arizona is a community property state, meaning that property you acquired during your marriage belongs to both of you. Keep in mind, however, that inheritances and gifts given to only one of you are still considered separate no matter when they were received.

If you own separate property, it will go to your spouse either entirely or partially. The amount your spouse receives will depend on whether you have any children or grandchildren from someone other than your spouse. If you do, your spouse and descendants will all have access to the separate property you leave behind when you die.

Heirs Other than Spouses or Children

If you leave behind no spouse or children, your property will pass equally to your parents according to intestate property laws. If they aren’t still alive, it will go to the parents’ descendants. If none of this applies to your situation, the descendants of the maternal and paternal grandparents will receive the assets in the estate in equal measure. If you don’t have any qualified blood relatives who can claim the property, it will go to the state. Keep in mind that charitable organizations or friends will not be able to inherit your property if you don’t leave a will behind.

How Working With an Attorney Can Help

Probate code can be intimidating, and it’s important that you leave your loved ones with what they deserve. In some cases, there’s a lack of agreement on how assets are distributed or confusion about intestate succession. An estate planning attorney can help answer any of your questions and give you professional guidance during the process.

Frequently Asked Questions on Intestacy and Estate Planning in Arizona

Here are some common questions related to this topic:

Q: What is partial intestacy?

It’s possible to die partially intestate, meaning that you left a will, but it didn’t cover all of your assets and that the ones you didn’t cover will pass according to intestate inheritance laws. You can avoid partial intestacy by creating a will with a residuary clause. This clause will provide that leftover assets that you haven’t assigned to someone must go to your designated beneficiaries.

Q: Which assets are affected by intestate inheritance rules?

Intestate inheritance laws only work for estate or probate assets (not non-probate assets). Non-probate assets are typically held in trust, already designated to a beneficiary by the owner, or owned with right of survivorship or joint tenancy. Under Arizona law, bank accounts that you own with at least one other person automatically have right of survivorship and joint tenancy. This means that the account will go to the surviving owner when the other owner passes on.

Q: What does “next of kin” refer to?

Next of kin simply means your closest blood relative. This relationship is important when it comes to inheritance rights after a person passes on without a spouse, children, or will. Keep in mind that the next of kin often has certain obligations both during and after their relative passes away, such as making medical decisions if their relative becomes incapacitated or taking care of finances.

Q: How do intestate succession laws treat half relatives?

Half relatives have the same rights as “whole” relatives when it comes to intestate succession. For example, if you have the same mom as your brother, but not the same father, your brother will have the same rights as you do when it comes to property.

What to Do if You Need Help

Many people assume that they’ll receive an intestate share of their relative’s estate and find out later that they won’t inherit anything. Your relative might have debts that go beyond the value of their assets or there may be other complications. If you’re unclear about your legal rights concerning intestate succession, it’s imperative that you speak with an estate planning attorney right away.

Call our Arizona Estate Planning team at (480)467-4325 to discuss your case today.